In 2022, Rakuten Securities' point deterioration, news of increased NISA account tax exemption limit, end of Neo Mobile Securities

Due to such announcements, the number of people who change their NISA accounts from Rakuten Securities to SBI Securities is increasing rapidly.

Therefore, I will explain how to transfer a NISA account with an actual screen.

It's super easy because it's done in 3 steps!

Flow of changing NISA account from SBI Securities to Rakuten Securities

1, Receive an "account abolishment notice" from Rakuten Securities

2, Receive a tax-exempt account opening notification from SBI Securities

3, Send SBI Securities a 3-item set (account termination notice, tax-exempt account explanation notice, identity verification documents)

4, Waiting for confirmation from SBI Securities and the tax office to complete the procedure

1, Carry out the change procedure at Rakuten Securities (receive an account abolishment notice)

・From the NISA/accumulation NISA account application screen, select Transfer NISA account to another financial institution

・Click Change on the Change Financial Institution screen

・Enter transaction PIN

・Acceptance completed

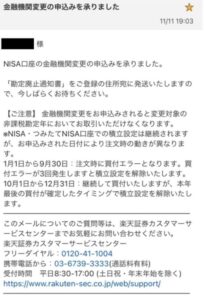

・You will receive an email confirming the change of financial institution

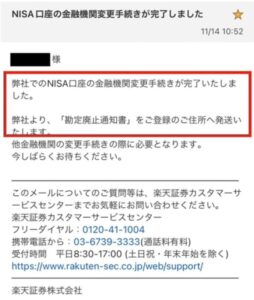

・You will receive a notification of the completion of the procedure to change the financial institution of your NISA account

※For me it arrived the next day

・The NISA/accumulation NISA account application/acceptance status screen is as follows

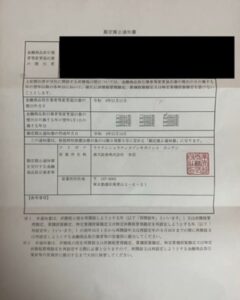

・You will receive an account cancellation notice

※In my case it arrived in 2 days

2, Get tax-exempt account opening notification from SBI Securities

・It is assumed that you have already opened an SBI Securities account. *Click here if you have not yet opened an account with SBI Securities

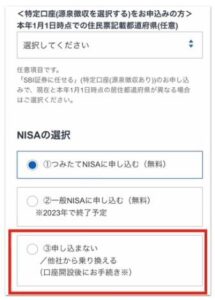

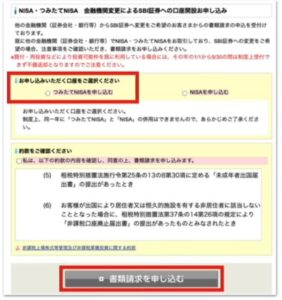

・From the NISA screen of SBI Securities, select the red frame ③ in the selection of NISA

・After selecting NISA accumulation or NISA, click Apply for document request.

・The status of NISA/accumulation NISA is changed to document request as shown in the red frame.

3, Send a 3-piece set to SBI Securities

We will send the account cancellation notice from Rakuten Securities, the tax-exempt account opening notice from SBI Securities, and the identity verification documents to SBI Securities in the enclosed envelope

4, Waiting for confirmation from SBI Securities and the tax office to complete the procedure

If everything goes smoothly, the process will be completed in about two weeks.

It was easy, right?

Why I changed my NISA account to SBI Securities, living in the Rakuten economic zone

The reason why I am changing my NISA account to SBI Securities now is because I spend more than 1 million yen a year in the Rakuten economic zone.

1, SBI Securities investment trusts are cheaper

The decisive factor is that SBI Securities has lower trust fees.

The higher the deposit amount, the greater the difference.

Rakuten Securities: The minimum trust fee for domestic stock index funds is 0.176% *As of September 2022

SBI Securities: The minimum trust fee for domestic stock index funds is 0.154% *As of September 2022

Rakuten Securities: The minimum trust fee for overseas stock index funds is 0.10989% *As of September 2022

SBI SECURITIES: The minimum trust fee for overseas stock index funds is 0.0968% *As of September 2022

2, End of Neo Mobile Securities

Due to the management integration of SBI Securities and SBI Neo mobile Securities (scheduled for January 2024), it has been decided that Neo mobile will actually end.

From January 2024, SBI Securities' S share purchase fee will be practically 0 yen.

Because I wanted to continue to use the Japanese high-dividend stock investment that I had been managing with Neo mobile under the same conditions using the NISA frame.

The second reason is that I decided to transfer my NISA account to SBI Securities.

3, get more points

As far as credit card accumulation is concerned, SBI Securities offers a maximum of 4% compared to Rakuten Securities (0.2%).

List of credit cards eligible for points

・Rakuten Securities

・Choice of Rakuten card: 0.2%

・SBI Securities

・Mitsui Sumitomo Card・・・0.5〜2.0%

・TOKYU・・0.25〜4.0%

・Takashimaya・・・0.1〜0.3%

Lastly

Whether Rakuten Securities or SBI Securities is right for you is a matter of pros and cons.

I may also return to Rakuten Securities.

Please invest at your own risk. We hope this information will be of help to those who were at a loss about changing their NISA account.

Regards,