Hello, it's Hiro.

I was stayed in the United States for three years from 2015 to 2018, so

Here are three excellent credit cards that I have been using since I was US expatriate.

As you know, credit history (credit score) is extremely important in the United States.

We don't have that system yet in Japan.

The credit history which I was not familiar with when I lived in Japan, made me realize how different things can and cannot be done by people who have credit in the United States since I started living in the United States.

※This article can be read in 3 minutes.

Without a credit history, you can't make a credit card in the US in the first place

In America, you can't survive without a credit card.

I have rarely seen anyone who uses a credit card and carries cash with them wherever they go.

You can pay in cash at the gas station, but you will have to communicate with the kiosk clerk, and if you go 10 times, you will probably get rid of it once.

Anyways, you can't survive without a credit card in America.

So how can a Japanese person without a credit history in the United States make a credit card?

About it, no worries.

There are card companies that are making special screening criteria for Japanese people who have just arrived in the United States.

At my company, ANA CARD USA was forcibly made before moving to the United States and was carried with a debit card.

Annual membership fee is paid by the individual

Both have services for those who are planning to move to the United States within 90 days, so be prepared as soon as 3 months before you arrive in the United States.

It also comes with various benefits, so it is especially advantageous for those who use ANA.

By the way, my company was recommended by Delta Air Lines, so I never used ANA for three years.

How to improve your credit history?

If you make and use your first credit card, you will be surprised to receive direct mails for credit card information from various companies like a demon.

The credit company is looking at you.

By using a credit card and continuing to pay properly by the payment deadline, your credit history will be accumulated.

In America,

Credit history = personal credit, so use your credit card.

If you keep your credit card without canceling it, your credit history will continue to grow even if you do not use it.

This is true.

I returned to Japan in 2018 and have never been to the United States since then, but my credit history is still alive and my points are increasing.

"You are not going to the United States anymore, so why not cancel my credit card?"

It's a matter of course, but I won't cancel.

There are several reasons,

Why I Keep Owning an American Credit Card

- Available for foreign currency deposits

- Can be used for overseas travel (American credit cards are usually free of exchange fees even when used overseas)

- There are a lot of support in case of trouble (depending on the company, there is an image that you will be more friendly than in Japan. There are many companies that are available 24 hours a day, so you can rest assured)

- As the credit history continues to increase, credit will be high from the beginning when you move to the United States in the future (image of starting Dragon Quest from the beginning at about level 50)

As a disadvantage,

- Annual membership fee will be incurred

Is it about?

There are companies that can easily make credit cards with no annual membership fee, so I will introduce some of them.

Delta's AMEX (AMEX Delta Skymiles Gold) should definitely be with you

The most recommended. It's very easy to earn Delta indefinite miles. * All my colleagues had

Get 70,000 mile points for free in the first year!

70,000 miles is about 100,000 to 150,000 yen in monetary terms!

If you plan to stay for less than a year, just bring it with you and you'll get 70,000 miles. You may cancel your contract if you receive 70,000 miles.

You can fly from Nagoya to Detroit in 35,000 miles, so you can use the round-trip airfare from Japan to the United States virtually free of charge!

The annual membership fee is $ 99, but it's worth more.

By the way, Amex is the cheapest credit card company in the United States, so I recommend it.

In my case, I went to the United States in June 2015 and applied for this in August, and the examination passed easily.

If you are a company that can get the average salary of expatriates, I think you can apply for it the month after you arrive in the United States.

The Hilton HONORS Credit Card is free of charge for many years, so you should keep it for the time being

This is a card that you should make if you use Hilton with no annual membership fee.

In fact, there is no annual membership fee and there is no loss in making it, so let's apply immediately!

As a benefit, you will receive the benefit of using a Hilton hotel for 100,000 points (free for one night)!

100,000 points are $ 400- $ 500 in monetary terms!

By using a Hilton hotel, you can rank up each time, enhance amenities, park in the parking lot in front of the hotel, and enjoy a VIP feeling.

Obviously, points are also available in Japan.

ANA CARD USA

It is possible to create it before coming to the United States, and Japanese support is also generous, so it is recommended as a credit card for the first time when you come to the United States.

I think that those who frequently use ANA may have the advantage of continuing to use it.

I canceled the contract immediately when I returned to Japan.

The reason is that the annual membership fee, ANA miles have an expiration date, and it is harder to collect miles than Delta.

Which credit card company can make it in the first year?

Probably, I think it will be limited to Amex.

I applied for VISA and Mastercard twice in the first year, but neither passed the examination.

By the way, I applied for

Marriott Business American Express Card(VISA)

Amazon(Mastercard)

Apply for a salary of about $ 80,000 at that time

Certainly, apart from credit card history,

Have lived in the United States for at least one year

I think it was stated. That's impossible, isn't it?

Amex's examination was super easy, so I applied for it, but it didn't work.

You can think that VISA and Mastercard cannot be made almost 100% in the first year of traveling to the United States.

Summary

When you are stationed in the United States, make an ANA or JAL card before you arrive in the United States, and make a Delta Gold Card and a Hilton Card one month after you arrive in the United States.

Other bloggers residing in the United States have also been mentioned in the article, but it seems better for those who use Delta Air Lines to apply for a Delta Gold Card without thinking about anything.

Then, collect credit history, raise credit points, and create your favorite VISA or Mastercard credit card in the second year.

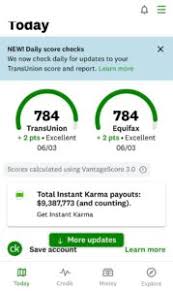

By the way, my current credit score is below.

It is said that the average in the United States is 680-700, so even though I have been in Japan for three years, I have received the highest evaluation.

It seems good to move to the United States.

※EXCELLENT for 760 to 850

Regards,

hiro